IAB Say Digital Ad Spend Is Up 3x – But Where Is The Value?

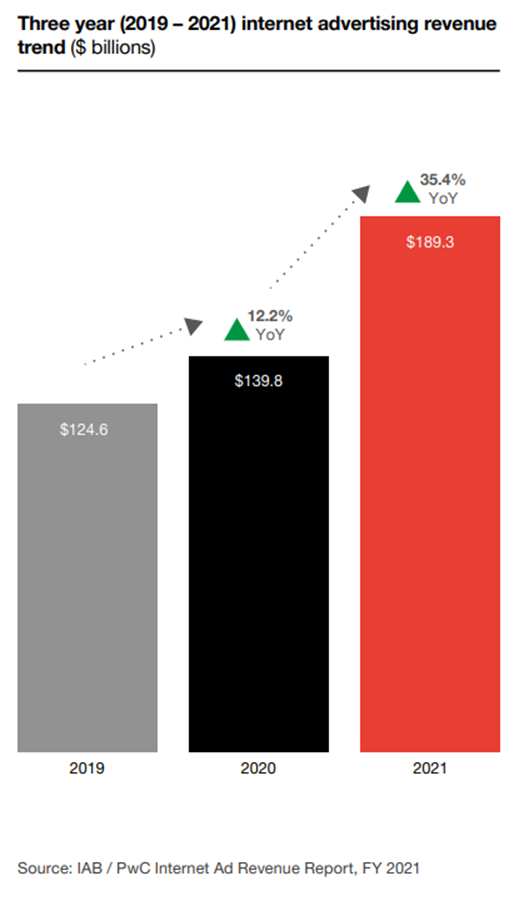

On the face of it, recent stats on rocketing ad spend, released by the IAB in their full year report into Advertising Revenue last month make for impressive reading.

We will dig into the detail in a moment but, from a pure headline perspective:

- Advertisers spent 3 x more year on year in 2021 (versus 2020)

- The jump of $50bn represents the highest single year increase since 2006

These are significant figures. But the key question for us here at QueryClick in all of this is – are these huge increases in spend translating into real value for advertisers?

Digital advertising soared 35% in 2021

According to the report digital ad spend was up $50bn year on year in 2021 to $139.8bn.

Even allowing for a digital economy that was emerging from the pandemic the figures are impressive and some of the key highlights included:

- Social media advertising increasing by almost 40% (39.3%) to $57.7bn

- Digital video continuing to be one of the fastest growing channels up 50.8% to $39.5bn

A quote from Libby Morgan who is the IABs Chief Strategy Officer provides more context in the report:

“We fully expected 2021 to be an exceptional year for digital ads. But even we were surprised at the degree of acceleration of growth. Not only was every single digital channel up, but some were up more than 50% year on year. This year’s increase is 3x what it was last year.”

In the UK, digital ad spend increased by a very healthy 41% in 2021 and hit a record high of £23.5bn.

The findings are 100% in line with a recent study by Harvard Business School which suggested that the ad supported digital economy has grown an incredible 7 times faster than the core US economy over the past 4 years.

Is there real value for advertisers in the increased spend?

So, spend is up – and quite significantly. But are advertisers really getting the value they are looking for?

We are not so sure.

Based on our experience here at QueryClick we think there are some challenges – and opportunities – associated with this increased level of spend.

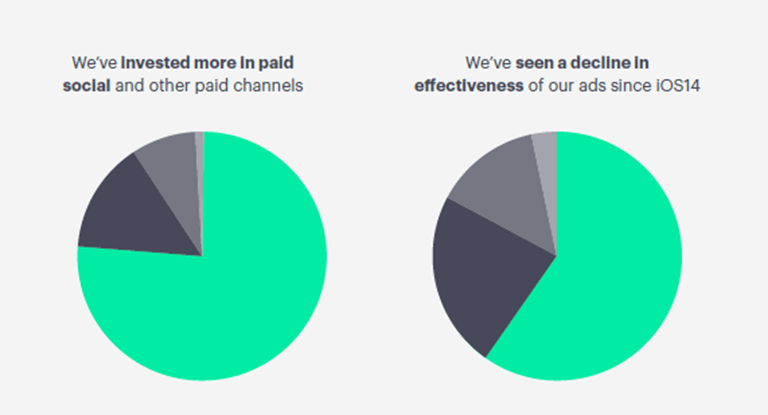

Despite the increase in spending in Paid Social – which is up 40% year on year – it is not all plain sailing for brands who are facing challenges on a number of fronts including:

Increasing CPM costs – and the effects of saturation

At the most fundamental level brands are facing significant increases in what they are having to pay for social inventory.

According to the Drum, there was a 61% increase in CPM year on year at Facebook/Meta – and Google saw an increase of 75% in the same time period. There have even been isolated reports of increases of 1000% in specific niche search terms – not the norm but indicative of a broad upward trend more or less across the board.

The reasons for this are varied and quite difficult to unravel entirely but range from the impact of IOS 14 – which had a disproportionate impact on Facebook ads – to the fact that there is an increased demand for YouTube ads as Connected TV increases in popularity.

All of this is placing upward pressure on budgets in a channel that was already facing issues around saturation.

iOS14 is impacting ad effectiveness

Alongside the upsurge in social costs is the impact that the iOS14 update has had on the effectiveness of social ads.

The decision by Apple back in 2020 that it was going to give users the option to opt-in for tracking across apps and websites for the purposes of delivering personalized ads was always going to have a an impact on performance.

Particularly for channels like Facebook, which has seen a serious reduction in audience sizes, drops in volume, delayed reporting, estimated results and a lack of breakdowns to enable ad targeting.

Plus, limitations in attribution window settings. And the impact has been dramatic.

According to our own recent research, 60% of marketers have seen a decline in the performance of their Facebook ads since iOS14.

Couple this with the fact that proving ROI on increased spend is proving equally challenging with only 16% of marketers indicating that they were seeing increased ROI from it – despite a whopping 76% confirming they had invested more in paid social.

Part of the challenge here is that marketers are heavily dependent on the quality of reporting provided by the big Adtech players including Google, Facebook and Amazon. This, in turn, suffers from the fact that they are effectively marking their own homework to issues with data quality which means that up to 80% of the data is being attributed incorrectly – in the case of solutions which rely on Google Analytics.

Add in the fact that the way that data is reported back in a siloed fashion means you aren’t able to connect the dots across the customer journey and you begin to see some of the limitations that marketers are facing as they try to assess ROI.

Digital video spend up 50.8% – but true incrementality is elusive

As we might have expected there is increased spend in digital video, in fact to quote the IAB report itself:

“Digital video continues to be one of the fastest growing channels, up 50.8% compared to last year, with total revenues of $39.5B.”

So budget is pouring into video partly in response to the saturation that advertisers are experiencing in other channels. But are advertisers seeing the results they need from it?

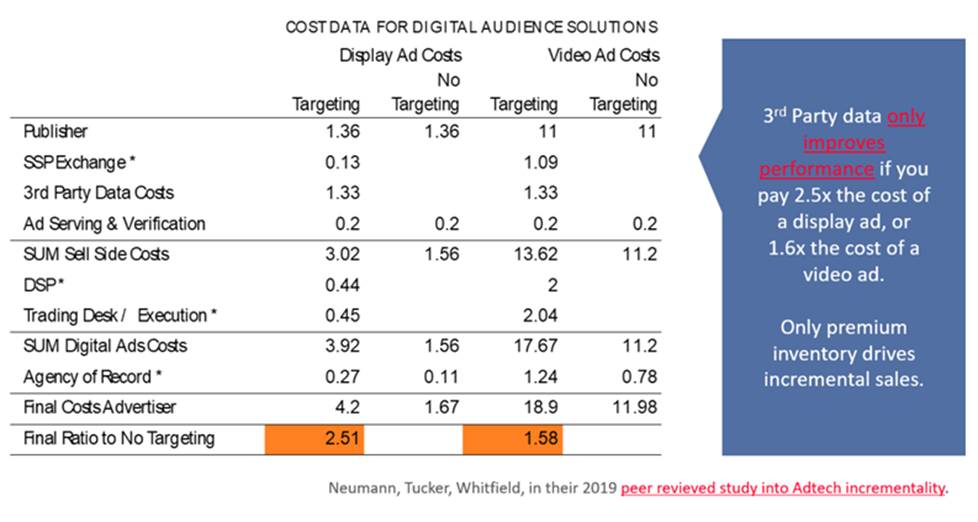

This stat, in particular, brought to mind the results of a fascinating, publicly available study by Norman Tucker and Whitfield which considered incrementality in this type of Video based spend. There is a synopsis of the finding below.

Effectively the study looked at incrementality across billions of dollars of media spend for third-party data for retargeting activity across display and video.

The upshot? To get any incrementality at all:

- for a normal display ad (so an image-based display ad) you need to be spending two and a half times the cost of the ad itself

- and for video, you need to be spending over one and a half times the cost

And that really is telling us that it’s only premium inventory that is driving incrementality when it comes to using third party targeting data of any kind. Which is challenging.

Genuine concerns exist over trust with AdTech providers

This is also a big one – in fact, our research survey back in 2021 uncovered the fact that 80% of marketers were concerned about bias in AdTech channel reporting.

We are all aware of the ease with which the main AdTech providers like Facebook, Google and Amazon create a false sense of security around their approach to managing data and more specifically how they are reporting back to us. But, in our experience, there are an increasing number of brands that are questioning the efficacy of their data.

And there are two specific examples below that might partly explain why that is.

- Firstly, there appears to be a drip feed of news about the conduct of AdTech providers coming out that is giving cause for concern. For example, only last month Google Analytics was declared illegal in the EU, a topic we covered in our blog Are Your Web Analytics Legal? And more recently, research emerged that alleged Amazon uses voice data from Amazon Echo conversations to target ads in potential breach of privacy agreements to return ad premiums 30x higher than usual.

- And secondly, from our own experience, when you begin to dig beneath the surface of what your Paid Social data is telling you then you, more often than not, find out that all is not as it might seem.

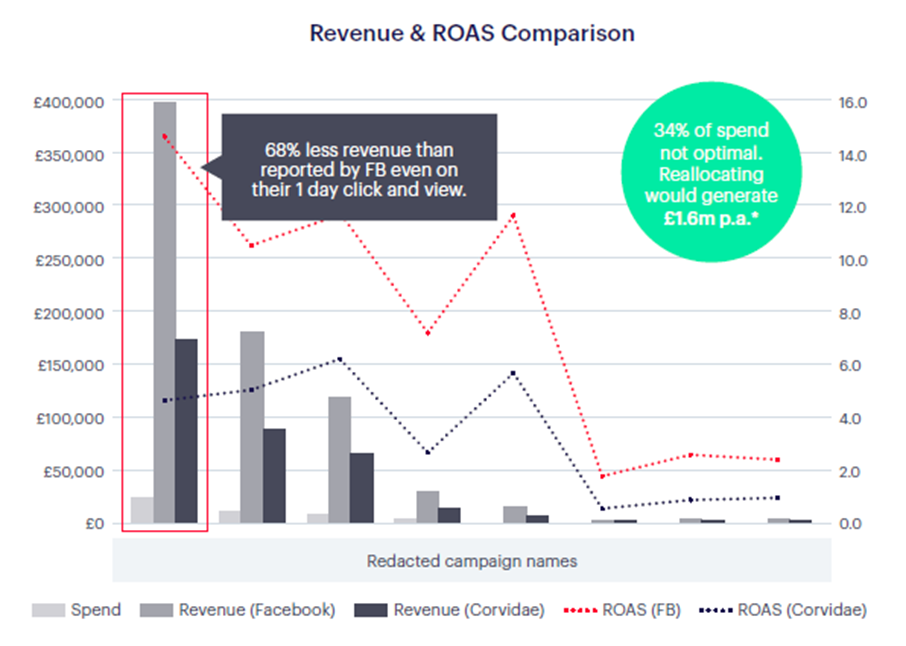

Consider the instance below. This is a live example – for a well-known online clothes retailer in the UK – where we didn’t take what Facebook spend data was telling us about attributed revenue on trust. And decided to dig deeper to validate what AdTech reporting was showing us.

In this case, not only were Facebook reporting 68% more revenue than was properly attributed by our Corvidae platform. But an incredible 34% of spend was not optimal and Corvidae was able to identify that re-allocating it would generate an additional £1.6m p.a.

Lack of a cross channel view often makes accurate measurement impossible

One final thought before we close.

The case above is just one example for a single client, in one channel for a subset of campaigns. Multiply this up by a typical client using 3 AdTech platforms with a myriad of other marketing activity both on and offline and you begin to see why accurate measurement can be a challenge.

No surprise then 60% of marketing decision-makers believe that data to support cross-channel decision-making is broken.

Is there an effective answer to these challenges?

So, as digital spend increases, is there an effective answer to some of the challenges we have outlined above?

Fortunately, there is. At QueryClick we have a solution that enables you to:

- Mitigate the impact of increasing ad costs by providing a clear picture of what is – and isn’t working – right across your media mix

- Combat the decline in the effectiveness of paid social post IOS 14

- Reclaim a degree of data reporting independence from the big AdTech platforms by enabling you to rebuild your data from the ground up

- Get the cross-channel attribution view you need to drive revenue and ROI

We call it Corvidae.

Need to assess your own digital spend levels and find out how much ROI you can unlock with Corvidae? Try our ROI Calculator as a starting point.

Own your marketing data & simplify your tech stack.

Have you read?

I have worked in SEO for 12+ years and I’ve seen the landscape shift a dozen times over. But the rollout of generative search engines (GSEs) feels like the biggest...

As you will have likely seen, last week Google released the March 2024 Core Algorithm Update. With it, comes a host of changes aiming to improve the quality of ranking...

After a year of seemingly constant Google core updates and the increasingly widespread usage of AI, the SEO landscape is changing more quickly than ever. With this rapid pace of...