Google’s New Digital Services Tax: What Does it Mean for Advertisers?

With the news that Google’s UK customers will be fronting the cost of a new digital services tax, we take a look at what’s driven the change and the impact it will have on advertisers.

What is the 2% Digital Service Tax?

The UK digital service tax is a 2% levy on tech giants announced by former chancellor Philip Hammond back in March. It accompanies renewed calls from the UK and EU for a global digital tax l, despite the US exiting talks in June.

In an e-mail sent on Tuesday, Google informed customers they’ll be the ones absorbing the cost with a 2% ‘UK DST Fee’ added to Google and YouTube ad invoices from November 1st. It’s set to apply to media spend on Google Ads but will allegedly not affect DV360 – Google’s own Demand Side Platform.

What does it mean for advertisers?

Put simply, it means advertisers will bear the brunt of the new tax rather than Google itself. Advertisers should expect the cost of their paid media activity to increase from November and should start evaluating the potential impact of this now.

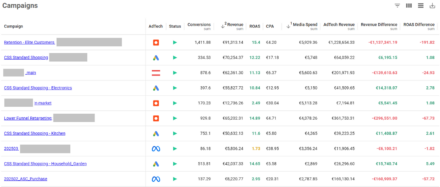

The fees will need to be factored into costs-per-acquisition (CPA) and changes may have to be made to keep campaigns efficient and deliver a healthy ROI. According to Google’s Help Page, the fees will be added “on top of your account budget,” and may be charged after payment has been fully spent.

Overall, they’re expected to cost marketers an additional £120 million annually in extra paid spend.

Phil Smith, director general of ISBA, said the changes were “disappointing,” and “the inevitable outcome of the UK’s unilateral approach to digital taxation.”

He continued; “We have been consistent in warning government of the potential consequences of this approach, including the risk of an increase in costs to advertisers in the UK market.”

A Google spokesperson rebuffed criticism in a comment to City A.M, stating: “Digital service taxes increase the cost of digital advertising.

“Typically, these kinds of cost increases are borne by customers and like other companies affected by this tax, we will be adding a fee to our invoices, from November.”

Google isn’t the only tech giant set to pass the cost on to customers. Amazon has also announced it will be charging a new fee to marketplace vendors, and Facebook and Microsoft are expected to make statements soon.

eBay, on the other hand, has said it will absorb the cost of the new tax with no change to payments for buyers and sellers.

The QueryClick view

This will have an impact on the advertising budgets of companies up and down the country, especially as PPC plays a key role in driving conversions for ecommerce sites. Effective management coupled with rigorous performance analysis and optimisation will be more important than ever to ensure ROAS targets are hit with the increased cost of getting traffic from this channel.

QueryClick CEO and founder, Christopher Liversidge, shared his thoughts on the announcement:

“Passing the newly levied UK tax straight through to advertisers is a big statement from Google, suggesting it’s willing to accept lower overall advertising growth from advertisers still struggling to recover from lockdown in key markets such as retail.

“I expect we’ll see Google seeking to point to increased value offered by their AdTech to support advertisers and rationalise away the criticism that they should accept lower operating margins now that they’re being taxed for operating in a market they dominate.

“Around 80% of the £14bn spent on digital advertising in the UK last year was shared between Facebook and Google. They have a responsibility to their advertisers, and as a significant employer in the UK, to contribute to the economy they benefit from.”

For more industry news and insight, check out our blog and knowledge base.

Own your marketing data & simplify your tech stack.

Have you read?

Chrome’s announcement on dropping cookie opt-in last month closed the door on a 5 year saga for marketers. But what is the landscape like in 2025 for cookie-based measurement?

Generative AI is transforming the way that marketers plan and assemble content for their Paid Ads. As big platforms like Google, Meta and TikTok increasingly build the tools needed to...

In a surprising move that has sparked heated debate, Mark Zuckerberg announced on his Instagram that Meta will be reducing its levels of censorship and in particular fact-checking on its...